In today’s world, as more and more people become participants in the global economy, the need for convenient and fast payment methods arises. One such method is using a virtual card for payment abroad. In this article, we will discuss the main advantages of virtual cards from foreign banks and describe X services that allow issuing a virtual card for online payments. This is particularly relevant for those involved in traffic arbitrage and want to pay for foreign services with a virtual card.

What are Virtual Cards from Foreign Banks?

Description of the main characteristics of virtual cards

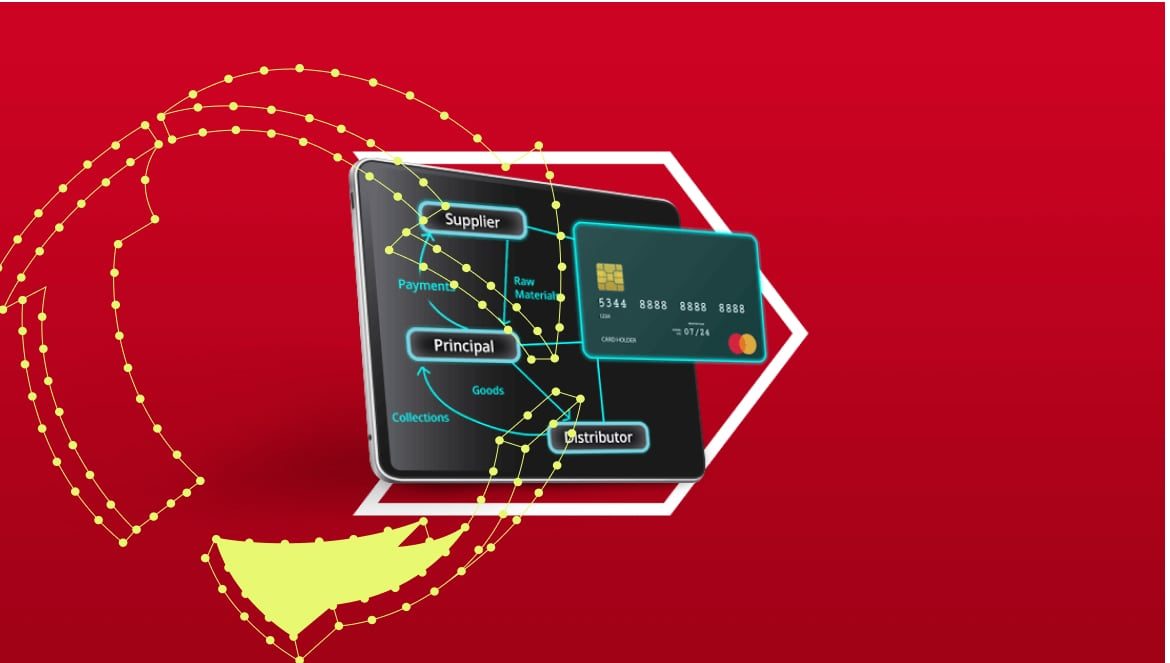

Virtual cards are specialized banking products designed for non-cash transactions and operations on the Internet. They look like regular bank cards but differ from them in the absence of a physical medium. Instead, virtual cards have only a number, expiration date, and CVV code, which are used to pay for goods and services online. Virtual cards can be linked to foreign banks and issued in different currencies, making them a convenient tool for payment abroad.

Advantages of using virtual cards from foreign banks for traffic arbitrage

One of the main advantages of using a virtual card for online payment is that they provide the ability to pay for services and goods from foreign companies and services without the need to open accounts in different banks. This saves time and effort for the user, especially if they are involved in traffic arbitrage and need prompt payment for foreign services.

In addition, virtual cards from foreign banks provide a high level of security, as they cannot be lost or stolen. Thus, the risk of fraudulent transactions is minimized.

Issuing a virtual card from a foreign bank for traffic arbitrage: a review of 10 services

For those involved in traffic arbitrage and want to use the services of foreign services, issuing a virtual card from a foreign bank may be an excellent solution. In this section, we will give a brief overview of X services that offer virtual card issuance for arbitrage, their features and limitations, pros and cons of the service, types of cards for issuance, and rates for issuance and maintenance.

FuncWallet

FuncWallet is a universal solution for traffic arbitrage, providing instant issuance of virtual cards, support for multiple currencies, and the ability to transfer funds between users. The service offers free virtual card issuance and access to a mobile app for managing your account. FuncWallet also ensures security and protection against fraud, thanks to the use of modern identification and verification technologies. However, it should be noted that FuncWallet may be unavailable for residents of some countries.

TransferWise

TransferWise offers virtual debit cards with low fees and support for multiple currencies. The service allows receiving local bank details in different countries and accepting payments in different currencies without additional fees. TransferWise also offers a mobile app for managing your account and tracking transactions. Limitations include that TransferWise may not issue cards for residents of some countries.

Payoneer

Payoneer is a popular service for traffic arbitrage, offering virtual cards with support for multiple currencies. The service provides a simple and convenient way to receive payments from clients and partner companies worldwide. Payoneer also offers a mobile app for managing your account and tracking transactions. Limitations include the issuance of cards only for residents of certain countries and fees for currency conversion.

Revolut

Revolut is an innovative service that offers virtual cards for traffic arbitrage with support for multiple currencies and low fees. The service also offers the ability to obtain local bank details in different countries and integration with popular payment systems. Limitations include that Revolut may be unavailable for residents of some countries and may charge fees for using the card abroad.

N26

N26 is a European bank that offers virtual cards for traffic arbitrage with support for multiple currencies and low fees. The service provides a simple and convenient way to manage your account and track transactions through a mobile app. N26 limitations include the issuance of cards only for residents of certain countries and fees for currency conversion.

Skrill

Skrill is a payment system that offers virtual cards for traffic arbitrage with support for multiple currencies and access to instant fund transfers. The service provides a simple and convenient way to receive payments from clients and partner companies worldwide. Skrill limitations include the issuance of cards only for residents of certain countries and fees for currency conversion.

EcoPayz

EcoPayz is a payment system offering virtual cards for traffic arbitrage with support for multiple currencies and access to instant fund transfers. The service provides a simple and convenient way to receive payments from clients and partner companies worldwide. EcoPayz limitations include the issuance of cards only for residents of certain countries and fees for currency conversion.

EntroPay

EntroPay is a service offering virtual cards for traffic arbitrage with support for multiple currencies and access to instant fund transfers. The service provides a simple and convenient way to receive payments from clients and partner companies worldwide. EntroPay limitations include the issuance of cards only for residents of certain countries and fees for currency conversion.

Neteller

Neteller is a payment system offering virtual cards for traffic arbitrage with support for multiple currencies and access to instant fund transfers. The service provides a simple and convenient way to receive payments from clients and partner companies worldwide. Neteller limitations include the issuance of cards only for residents of certain countries and fees for currency conversion.

WorldFirst

WorldFirst is a service offering virtual cards for traffic arbitrage with support for multiple currencies and access to instant fund transfers. The service provides a simple and convenient way to receive payments from clients and partner companies worldwide. WorldFirst limitations include the issuance of cards only for residents of certain countries and fees for currency conversion.

CardPay

CardPay is a service offering virtual cards for traffic arbitrage with support for multiple currencies and access to instant fund transfers. The service provides a simple and convenient way to receive payments from clients and partner companies worldwide. CardPay limitations include the issuance of cards only for residents of certain countries and fees for currency conversion.

How to choose the right service

Tips for choosing the most suitable service for traffic arbitrage needs

When choosing a service for issuing a virtual card from a foreign bank for traffic arbitrage, consider several factors. First, assess the availability of the service and its reliability. Second, consider the fees and rates offered by the service. Third, consider how convenient and simple the service is to use and how quickly you can access a virtual card for online payment.

Considering key criteria

When choosing a suitable service for issuing a virtual card from a foreign bank for traffic arbitrage, pay attention to the following key criteria:

- Card issuance time

- Supported currencies

- Fees

In general, when choosing a service for issuing a virtual card from a foreign bank, consider your needs and preferences, as well as the key criteria described above. This will help you choose the most suitable service for traffic arbitrage and ensure the successful development of your business.

Risks and Limitations

Description of the main risks and limitations associated with using virtual cards from foreign banks for traffic arbitrage

Using a foreign bank card online for traffic arbitrage is also associated with certain risks and limitations. First, many virtual card issuance services have geographical restrictions, which may make them unavailable to users from some countries. Second, some services may have strict requirements for user verification, which may create difficulties when opening a foreign bank card online.

Also, keep in mind that virtual cards may be limited in their use for certain categories of goods and services, which may reduce their effectiveness for traffic arbitrage. In addition, there may be cases of card blocking due to suspicious operations or violation of service usage rules.

Tips for minimizing risks and overcoming limitations

To minimize risks and limitations associated with using a foreign bank card online for traffic arbitrage, consider the following tips:

- Carefully study the terms of use of the chosen virtual card issuance service and make sure it is suitable for your purposes and complies with the requirements of your country.

- Go through the verification on the chosen service to ensure reliable access to the foreign bank card online and avoid blocking.

- Monitor your transactions and operations to avoid suspicious actions and violations of service usage rules.

Conclusion

Overall, using a foreign bank card online for traffic arbitrage can be a useful and convenient tool that allows you to pay for foreign services without the need to open accounts in various banks. However, be careful when choosing a suitable virtual card issuance service and consider possible risks and limitations.